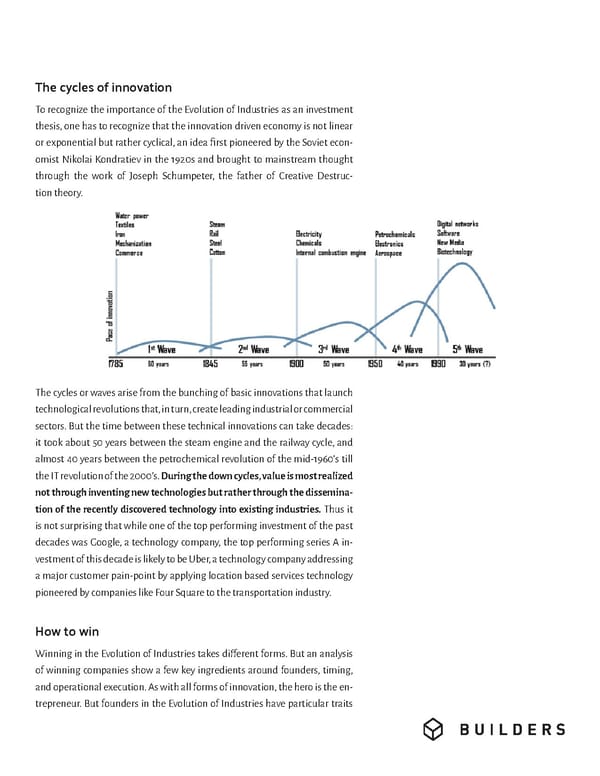

The cycles of innovation To recognize the importance of the Evolution of Industries as an investment thesis, one has to recognize that the innovation driven economy is not linear or exponential but rather cyclical, an idea first pioneered by the Soviet econ- omist Nikolai Kondratiev in the 1920s and brought to mainstream thought through the work of Joseph Schumpeter, the father of Creative Destruc- tion theory. The cycles or waves arise from the bunching of basic innovations that launch technological revolutions that, in turn, create leading industrial or commercial sectors. But the time between these technical innovations can take decades: it took about 50 years between the steam engine and the railway cycle, and almost 40 years between the petrochemical revolution of the mid-1960’s till the IT revolution of the 2000’s. During the down cycles, value is most realized not through inventing new technologies but rather through the dissemina- tion of the recently discovered technology into existing industries. Thus it is not surprising that while one of the top performing investment of the past decades was Google, a technology company, the top performing series A in- vestment of this decade is likely to be Uber, a technology company addressing a major customer pain-point by applying location based services technology pioneered by companies like Four Square to the transportation industry. How to win Winning in the Evolution of Industries takes different forms. But an analysis of winning companies show a few key ingredients around founders, timing, and operational execution. As with all forms of innovation, the hero is the en- trepreneur. But founders in the Evolution of Industries have particular traits

The Evolution Of Industries Page 3 Page 5

The Evolution Of Industries Page 3 Page 5